6 Reasons for Dividend Stocks

Volt NewsFor the past ten years, dividend stocks have been considered boring compared to growth stocks. They didn't captivate investors with gripping growth stories and innovations that would supposedly change the entire world. However, the spotlight on the securities stage has been refocused since this year. It’s time to recall why investors might be right to consider dividend stocks.

When a company makes a profit, a piece of the profit pie can be distributed to all shareholders. This compensates them for the risk they take when they buy a share. For investors, this provides the opportunity for a regular source of income. Additionally, there are other reasons why a broadly diversified dividend strategy is considered one of the classic tools in an investors' toolbox and has fallen into favor once again.

1. Compound interest effect thanks to reinvesting dividends

The dividend yield is a key figure that is usually in the single-digit percentage range. It shows the ratio between the last dividend paid out and the current price of a share. For example, if the share price is CHF 100 and CHF 5 is paid out, the dividend yield is 5 percent. Though this percentage may seem small, it is an important part of an investor’s total return. If the dividend is reinvested, the proportion increases over the years.

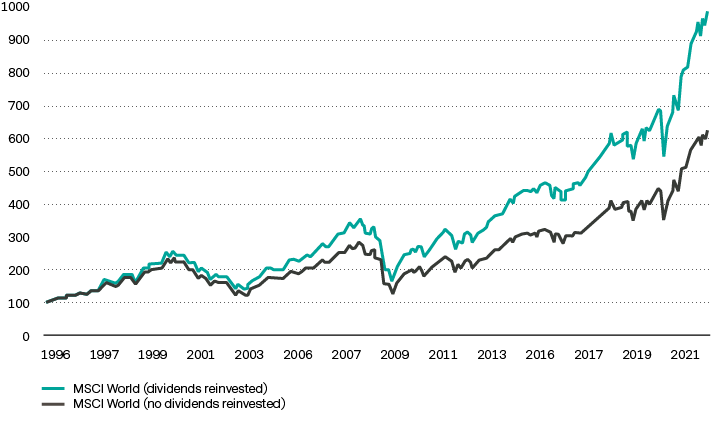

The performance of the MSCI ACWI Index is an excellent illustration of this fact. This can also be seen in the MSCI ACWI Index. This is the flagship among the global stock indices, which tracks the performance of around 3 000 stocks. 100 invested US dollars in 1995 have reached a value of almost 1 000 US dollars in 2021 if dividends had been continuously reinvested, but only 620 US dollars without reinvested dividends.

Performance MSCI ACWI Index from 1996 to 2021

Sources: Vontobel, Bloomberg, MSCI

2. The value era has dawned

Investors ignored their sometimes dizzying valuations of growth stocks in recent years as long as the price curve pointed upward. The fact that certain growth stocks paid no dividends also played a secondary role. Companies focused on fast market capture prefer to reinvest all profits to ensure rapid growth. At the beginning of 2022, sentiment tilted and investors started fleeing these high multiple growth companies into more stable value companies because the market started to anticipate faster than expected rate hikes by central banks worldwide.

The new darlings of the investment world seem to be value stocks. Dividend stocks have an implicit value tilt and hence benefit from this shift. Dividend aristocrats have strong positions in their industries, are growing steadily, and have paid handsome dividends without interruption over the past 10 years. If you look at the top performers among the value stocks, you will also find dividend high-flyers. Their longstanding dividend discipline is often reflected in their share price performance.

3. Dividend stocks are less volatile

US star investor Warren Buffett pays particular attention to the risk profile of an investment. One of his basic investment rules, for example, is "Avoid losses!" These can be limited during far-reaching market turbulence, not least thanks to active management. A study has shown that dividend stocks are less volatile, reflecting consistent operating performance and earnings quality. This is not only good for the nerves, but also for the wallet. In the case of companies that do not pay dividends, investors have to wait until the share price recovers before they can return to profit. In the case of dividend shares, on the other hand, at least a dividend can beckon even in the event of price losses if the company reports a profit.

4. Dividend stocks have a future

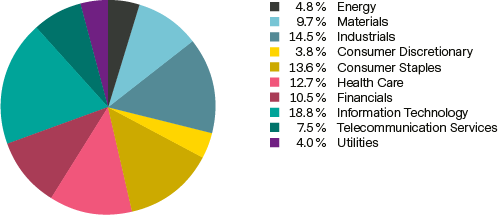

When selecting dividend stocks, it is important to look back. How has the dividend developed over the last ten years? Has it been suspended and for what reasons? However, it is at least as essential t to look ahead. For generating future profit, the company must be able to hold its own against the competition, stay on the growth path and innovate. The widespread belief that dividend aristocrats are only in industries considered defensive like in health care, consumer staples and industrials is false. The Global Quality Dividend Achievers investment module also includes stocks in companies operating in sectors that promise above-average growth, such as the technology and IT sectors.

Allocation by sectors of the Global Quality Dividend Achievers investment module. As of March 2022.

Source: Vontobel

5. Dividends increase the economical use of cash

Anyone who pays a dividend passes on part of the profit to the shareholders. This means that less money is available for investment. This can provide more discipline in management's investment decisions. Studies show that the more cash a company retains, the more likely it is to overpay for acquisitions. This, in turn, affects shareholder value. Companies that pay dividends tend to be more efficient in the use of their capital than comparable companies that do not. The psychological effect on management should also not be underestimated. No manager wants to lose face and break a series of dividend years or postpone the disbursement of dividends.

6. Better balance sheet

Our analysis shows that dividend-paying companies tend to have better balance sheets than non-dividend-paying companies. Companies with a long history of regularly increasing dividend payouts are supported by healthy cash flows. Earnings visibility also tends to be better, as a company must pay dividends from real earnings and cannot make them look better than they are through creative accounting.

Although there is much to be said for dividend high-flyers, this does not automatically mean that yesterday's winners will also be tomorrow's winners. We therefore closely monitor the business performance of our dividend favorites and keep an eye on the risk factors.

Risks of investing in financial markets

Investments in special topics on the international financial markets are associated with risks. The price, value and return of an investment, particularly in a special theme and across borders, depend, among other things, on economic developments, the global attention given to the theme in the international financial markets and the price of the underlying securities.