Start investing in tomorrow, today

Get a head start with volt on future trend investments and increase your potential to achieve above-average returns in the long term.

Invest

– with volt invest

Get a head start with volt on future trend investments and increase your potential to achieve above-average returns in the long term.

With volt, you can flexibly add numerous investment themes to your portfolio. Set your investment up for additional return potential and participate in the progress of these themes.

Our environment is subject to ever-increasing stress factors. Fortunately, governments and companies alike are working on solutions: from clean energy to resource efficiency. With "Cleantech", you can participate in the success of companies driving this positive change through innovative technology.

Thematic investments are experiencing a worldwide boom. And the range of topics is wide: from the energy transition to cannabis. With the "VF II - Megatrends Fund", volt by Vontobel investors have the attractive opportunity to participate in 13 promising future themes based on megatrends in one fell swoop.

Many companies in the market are not only economically successful but also take their social and environmental responsibilities very seriously. Invest in companies identified by our experts that have found clever ways to combine good returns with sustainability.

What will we eat tomorrow? This is the question 9.8 billion people will be asking themselves in 2050. This growth in population will mean that food production will have to increase 70 percent. Smart farming can increase the world’s harvest by two thirds. We estimate that this market will grow 6 percent per year in the years ahead.

Airbnb, Uber, Amazon – these three disruptors have fundamentally changed established sectors. Innovative companies successfully meet changing consumer demands with technological advantages and service offers, as well as tapping into new markets and target groups.

Strong brands are intangible assets through which a company can achieve a dominant market position and above-average returns. Competitors can hardly copy brands, and, once established, brands are associated with relatively low costs. Companies that have a strong brand often outperform the broad market.

The Western population is becoming increasingly older. This is causing bellyaches for governments and posing enormous challenges for the healthcare sector. The pharmaceutical industry has a key role to play here. With future blockbusters in drugs and vaccinations as well as digital solutions, it has a lot of innovative power in store. This creates opportunities for investors.

There are companies that simply and consistently do a good job of making profits and having a solid balance sheet for decades. Those quality companies are characterized by a consistent business model displaying a clear focus and sustainable growth potential, and remain in demand even during crises.

There is hardly an area of life that is not permeated by the digital world. E-commerce, cloud computing and artificial intelligence play an important role in the digital ecosystem. As technology advances, new possibilities and opportunities are constantly opening up.

The Swiss equity market offers a wide selection of reliably managed companies operating in promising sectors. The local stock market reflects the innovative and globally networked Swiss economy.

Fintech companies use technology-based systems to provide financial services that offer their customers benefits such as lower costs, greater efficiency, transparency, and independence.

The very first industrial robots saw the neon light of the factories 20 years ago. A lot has happened since then. Today, sophisticated sensors and advances in software technology are allowing us to venture into new spheres. Robots are gaining the ability to move in the real world, to react to unplanned events, and to engage in interactions. This marks the dawn of the real era of robotics and opens up exciting investment opportunities.

E-Sports and Gaming are the big players in the entertainment industry and have overtaken the film and music industry. E-Sports professionals are celebrated as modern gladiators and could soon carry the Olympic torch. And the potential is huge: With their smartphones, almost 4 billion people carry a gaming device with them.

Water is an irreplaceable commodity and supplies are limited. Although the oceans are full of it, only one in a thousand liters is drinkable. These facts collide with the increasing water consumption of mankind. Innovative solutions for infrastructure, water services and water efficiency are needed.

Whether it’s banks looking to develop a fintech app, grocers setting up e-commerce platforms, or car manufacturers automating their production lines, when it comes to hardware and software, more and more companies are turning to a cloud solution. In other words, they simply rent computing power, storage space and the applications they need online. This is not only more efficient than purchasing and operating their own IT infrastructure, but also allows them to scale the resources they use at short notice. Welcome to the era of cloud computing.

Through "Opportunities" you invest in individual securities which, in Vontobel's opinion, have upside potential due to the current market situation.

The energy revolution has begun. In the future, an increasing number of investments will flow into environmentally friendly energy sources. “Ener” focuses on companies that are one step ahead of the competition in the field of energy production and efficiency.

Download volt, choose your investment themes in just a few clicks and activate your portfolio. Our investment experts will take care of the rest.

All of volt’s 17 investment themes are derived from four major megatrends. Each of the four megatrends represents a global structural change that will have a lasting impact on our society.

Whether climate change, aging societies, or population growth, innovation is key to addressing major challenges. Even in less crucial areas, such as streaming services and payment service providers, technology is the measure of progress. Participate in technological change with these themes.

As awareness of resource scarcity and climate change increases, sustainable value creation is becoming more and more important. For companies, this means more than just cultivating an image. Companies without a sustainable strategy are already being punished on the stock exchange. Future markets are thus likely to be dominated by those companies that achieve their goals in a sustainable manner. Participate in sustainable value creation with these themes.

With the rapid rise of China, the United States is getting competition as a world power. India’s economic ambitions are also upsetting global political structures. For global markets, this means one thing above all: motion. Investors see the greatest potential in emerging markets and global connectivity. Participate in the shifts in our multipolar world with the following themes.

More and more people are living in cities. In addition, our society is aging. While urbanization demands ever new solutions for infrastructure and supply, demographic change requires a smarter and more efficient healthcare system. At the other end of the demographic spectrum, the consumption behavior of Gen-Z’s digital natives is forcing brands to rethink. Participate in demographic change and urbanization with these topics.

Global challenges need to be addressed. Companies that find themselves at the forefront of tackling these challenges are driving megatrends and thus have significant growth potential.

Megatrends represent long-term changes with global implications. Themes derived from these megatrends will thus be less likely to be affected by cyclical market movements.

Megatrends can be identified and experienced in our day-to-day lives. This gives you the opportunity to make decisions according to your convictions. We’ll take care of the rest.

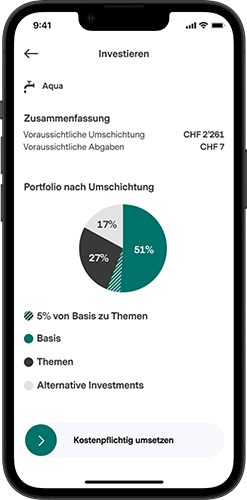

Adding themes to your portfolio is as easy as this:

Your selected theme is now part of your portfolio and will be actively managed for you by our investment experts.

Behind all of volt’s investment themes are Vontobel’s experienced investment experts who actively manage your portfolio. For you, this means:

Since themes are 5% of your equity quota each, this depends on your risk profile. The equity portion of your portfolio varies between 10% and 98% depending on your risk profile. For example, with the conservative risk profile, you can select up to two themes. With the dynamic risk profile, it is up to 18 themes.

Adding and removing themes is generally free of charge. However, depending on the traded products, there are costs for the financial instruments. For example, if an external investment fund is added to your portfolio, the manager of the fund charges a price.

You can add or remove themes from your portfolio as often as you like. Adjustment of your portfolio is done once a day as part of rebalancing. In some cases, rebalancing your portfolio can take up to 3 days.

Once you have activated a theme, you can see exactly which individual securities are in the respective investment.

At volt, experienced portfolio managers from Vontobel monitor the market and actively manage your portfolio. If relevant changes happen in the market, the instruments in your portfolio are adjusted to the new situation. This means, for example, that a security is bought or sold.

In the process, you are informed of all changes and movements in the app. This way, you retain control of your investments at all times and have the security of knowing that our investment specialists are looking after your portfolio on a daily basis—as if it were their own.