Alternative Investments: Diversify With Crypto?

Volt NewsWhat it's about

- Crypto is short for "cryptocurrencies" such as Bitcoin (BTC) and Ether (ETH). The thing that makes cryptocurrencies so unique is the technology that underlies them.

- The blockchain does not only serve as the basis for cryptocurrencies, but also offers potential for other applications beyond payment transactions. This makes crypto an interesting investment.

- But what points should you consider if you want to expand your portfolio with crypto?

Shares or crypto - many people seem to make their investment decisions according to this principle. How-ever, it does not have to be a question of exclusion, as classic investments and cryptocurrencies can be combined in a joint and long-term portfolio. After all, beyond speculation on quick profits, the technology on which Bitcoin and Ether are based, has long-term potential to offer.

What Is Crypto?

Crypto is often used as a short form for "cryptocurrencies". Many associate this term with the largest and probably best-known digital currencies: Bitcoin (BTC) and Ether (ETH). What makes cryptocurrencies so unique compared to classic investment opportunities is the technology that underlies them.

Before the emergence of crypto, it was not possible to send money digitally without transactions being controlled, approved and documented by an entity such as a bank or an online payment service provider, for example. But the "blockchain" connects senders and receivers directly without having to give up the benefits of an intermediary. While directly connected, all transfers are cryptographically secured and stored in the crypto-network, which according to proponents increases transparency, verifiability and the speed of payments made.

What Opportunities Does the Blockchain Offer?

The blockchain can not only be used as a basis for cryptocurrencies such as Bitcoin and Ether, but also offers potential as a foundation for other applications. For example, Ethereum, the network of the cryptocurrency Ether, describes itself as a programmable "general-purpose blockchain" that can also serve as a basis for purposes beyond payment transactions or currencies.

For crypto to become established in the long term, it is not so much the spread of cryptocurrencies that is crucial, but even more so the use of the underlying network in various areas. Pioneers in the successful use of crypto technology (only in German) include companies such as SAP, Oracle, Visa and Walmart, which have already developed their own applications based on the blockchain.

What Are the Challenges of the Blockchain?

A transaction in the blockchain is processed and secured on a large number of computers at the same time, which results in high energy consumption. In addition, the creation of new currency units requires large amounts of electricity, since each element is generated by solving complex mathematical tasks and has to be allocated on all computers in the network. The high expense has limited the practical use cases of blockchain so far. But a new system update is now counteracting the high computational effort and thus also the enormous energy usage.

Ethereum has become the first major crypto network to switch to a new computing method that is expected to make the technology faster, more secure and more energy efficient. "The Merge," as the network's update is being called, could not only make crypto-based applications more attractive to businesses, but also offer investors new reasons to invest in Ether. The switch may well be seen as an important step that could make cryptocurrencies more popular as a complement to traditional portfolios.

What Is the Potential of Crypto?

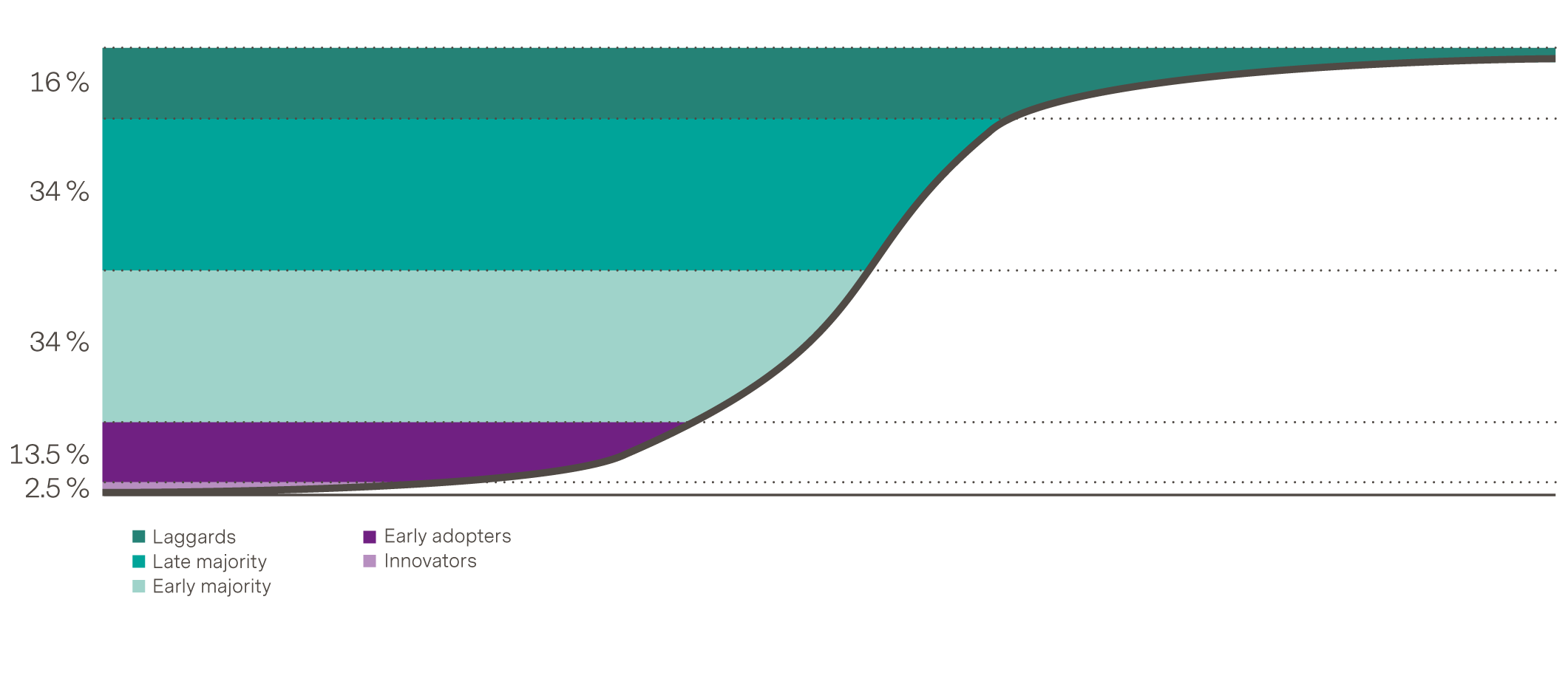

In the past, disruptive technologies such as the smartphone or the internet often developed along the "innovation adoption curve". It traces the development of previous technologies that had a similarly large potential and reached the mass market after several years. In this process, the early users, the innovators and the early adopters, are particularly important indicators of the success potential of a technology.

Innovation Adoption Curve: Typical User Innovation Adoption

Source: Blockware Solutions

According to experts, the spread of crypto shows similarities to the "innovation adoption curve". In the latest "Bitcoin User Adoption" report, Blockware Solutions looked at the development of Bitcoin using the "Innovation Adoption Curve". According to their publication, we are still in the "early adopters" phase of crypto adoption.

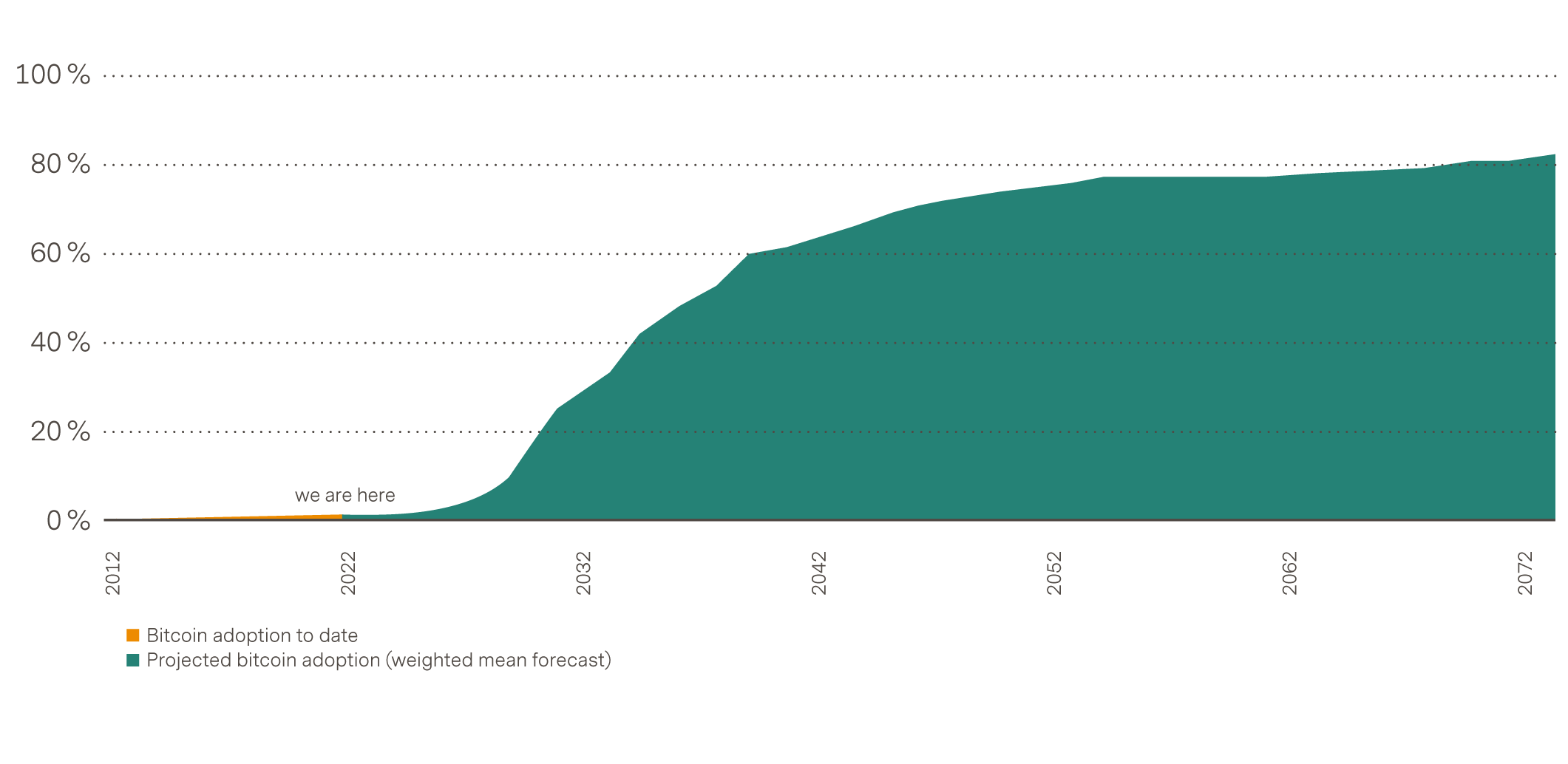

Percentage of the global population that might use Bitcoin

Source: Blockware Solutions

Blockware Solutions has identified similarities in Bitcoin's development to date with the growth of other innovations. The company compared the adoption of nine disruptive technologies in the U.S. and found that usually, the acceptance of an innovation grew strongly at an adoption rate of 10%. Considering the previous crypto adoption, this moment could be applied to crypto in 2030, according to the report. After that, a rapid increase in the number of users could follow, which would reach a large part of the population over time.

Is It Possible to Diversify With Crypto?

Anyone diversifying their portfolio generally wants to spread the risk of their investment and, in the best-case scenario, increase the potential returns at the same time. To achieve this, "alternative investments" like commodities are often used, which can develop independently of the markets, i.e. traditional investments such as shares and bonds. But does crypto behave like an alternative investment? Yes and no. In the beginning, cryptocurrencies developed independently of real currencies as more and more investors fled from them and wanted to participate in the rising prices in the crypto universe.

Meanwhile, the consensus stands that blockchain networks will have to prove themselves as a basis for mass adoption applications in the next step. The value of cryptocurrencies is likely to develop depending on the success of the applications that use the respective crypto networks as a basis. As a result, a certain correlation between crypto and tech indices is becoming more and more pronounced. Most recently, the value of the crypto market has fallen together with tech stocks. The question is therefore quite justified whether cryptocurrencies can still develop independently of tech indices such as the Nasdaq. Those who want to add cryptocurrencies to their portfolio should therefore mainly ask themselves whether they believe in their potential, and less whether they are suitable for diversification.

How to Add Crypto to Your Own Portfolio?

If you want to use crypto to expand or diversify your portfolio, a weighting of between 1 and 5 percent is just right, according to experts. A simple way to enrich your investment with crypto stocks are crypto trackers. These are certificates that follow the performance of the cryptocurrencies they contain. Thus, investors can participate in their development without having to own them themselves. A separate crypto wallet is not required and the investment is even protected against theft and hacker attacks, depending on the provider.

Basically, the larger the cryptocurrency, the more likely its price reflects the current development of the entire crypto market. The smaller the cryptocurrency, the more speculative it is. Therefore, to participate in the development of the crypto market, experts recommend Bitcoin and Ether, the two largest cryptocurrencies on the market.

Conclusion: More Than Just a Means of Payment

Crypto has the ability to permanently change the financial world as well as other economic sectors. This is because blockchain networks such as Ethereum offer the possibility of optimizing processes, speeding them up and making them more secure. The future potential of crypto is therefore not measured solely by the use of cryptocurrencies as a means of payment, but in the further possible applications of the crypto technology that lies behind it. Anyone who is convinced of the digital transformation through the blockchain can invest in crypto. To avoid the still high volatility, it can also make sense to supplement a long-term portfolio with a small amount of crypto.

Sounds interesting?

With volt by Vontobel, you can participate in the development of various investment themes as well as alternative investments such as commodities and cryptocurrencies.

Risks of investing in financial markets

Investments in special topics on the international financial markets are associated with risks. The price, value and return of an investment, particularly in a special theme and across borders, depend, among other things, on economic developments, the global attention given to the theme in the international financial markets and the price of the underlying securities.