Pension hack #2 – Make your pension assets work for you

Welcome to the second part of our pension planning series, where our pension planning experts show you how to get the most out of your Pillar 3a - and how you can benefit from it with volt 3a.

Everyone who uses the pillar 3a benefits from one advantage: the annual tax savings from the payments. When it comes to the annual return, the situation can vary. How high the return can be depends on which type of pillar 3a solution you choose – a simple account or a custody account with a securities solution?

The proportion of shares is decisive

At most banks, you can deposit your pension assets either in a pillar 3a account or in a pillar 3a custody account, in which the retirement assets are invested. With the conventional account solution, the annual return is fixed and depends on current interest rates. A custody account or securities solution, on the other hand, can yield a higher return, dependent on the capital markets. With such a solution, you usually have several investment strategies to choose from, which differ primarily in the proportion of equities.

The risk capacity and willingness as well as the planned investment period should determine the strategy (more or less shares). Ideally, this should also be reviewed and adjusted on an ongoing basis.

Higher return opportunities = higher risk?

In principle, the higher the proportion of equities in a securities solution, the greater the exposure of the pension assets to the financial markets. However, since the investments in a pillar 3a solution are usually designed for the long term - often over decades - interesting returns can be achieved over time. This could increase your retirement savings significantly.

The example of Peter and Anna, who both live in the city of Zurich, illustrates the differences between an account solution and a securities deposit.

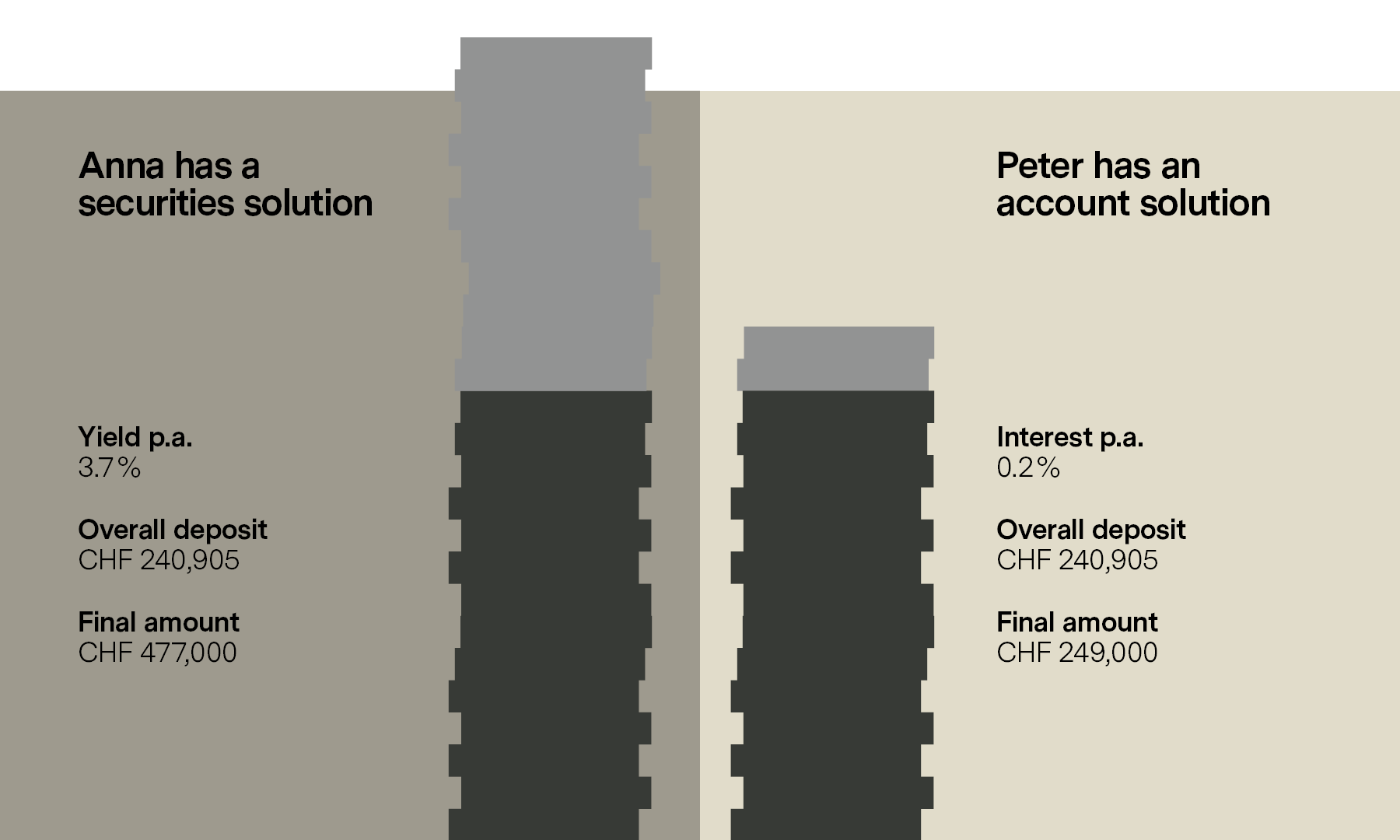

Anna receives over 91% more than Peter

Peter has opted for an account solution. He pays the maximum contribution into his Pillar 3a account every year (2021: CHF 6,883) for 35 years - with an interest rate of 0.2%. When he withdraws, his accumulated balance is around CHF 249,000 (before taxes).

Anna also pays the yearly maximum amount into her pillar 3a account every year for 35 years - but she has opted for a securities solution. She chooses a dynamic investment strategy in which the share of equities is 90%. The result: Her average net return is 3.7% (net after costs of approx. 1% p.a.), her assets amount to CHF 477'000 (before taxes) when she withdraws.

Anna therefore receives CHF 228,000 (before taxes) more than Peter. This would allow her to retire early, for example.

Our investment expertise for your pillar 3a

With our volt 3a digital pension solution, you not only benefit from the potential returns of a securities solution, but your pension assets are managed with the combined pension and investment expertise of over 90 years. What's more, we will conveniently transfer your existing pension assets for you on request.

Legal Disclaimer

A product of Bank Vontobel AG and the Vontobel 3a Vorsorgestiftung. Financial instrument costs of a maximum of 0.60 percent annually for volt invest and a maximum of 0.50 percent annually for volt 3a on the investment assets are incurred at all times. In addition, fiscal charges (including Swiss stamp duty) of up to 0.15 percent of the transaction volume may be charged on individual transactions. Additional costs may be incurred in accordance with the Vontobel 3a Retirement Savings Foundation's fee regulations. Clients must be over 18 years of age and resident in Switzerland. Further information is available at volt.vontobel.com.