Protection against inflation: When alternative investments make sense

Volt NewsAlternative investments are becoming increasingly popular. On the one hand, this is due to their characteristics, which help to protect a portfolio against negative developments on the market up to a certain degree. On the other hand, new apps and investment platforms are making it ever easier to invest in them. In addition, the current low-interest environment means that many private investors are currently seeing low yields. But making use of “Alternatives” should be considered carefully as they come in various forms and are often complex.

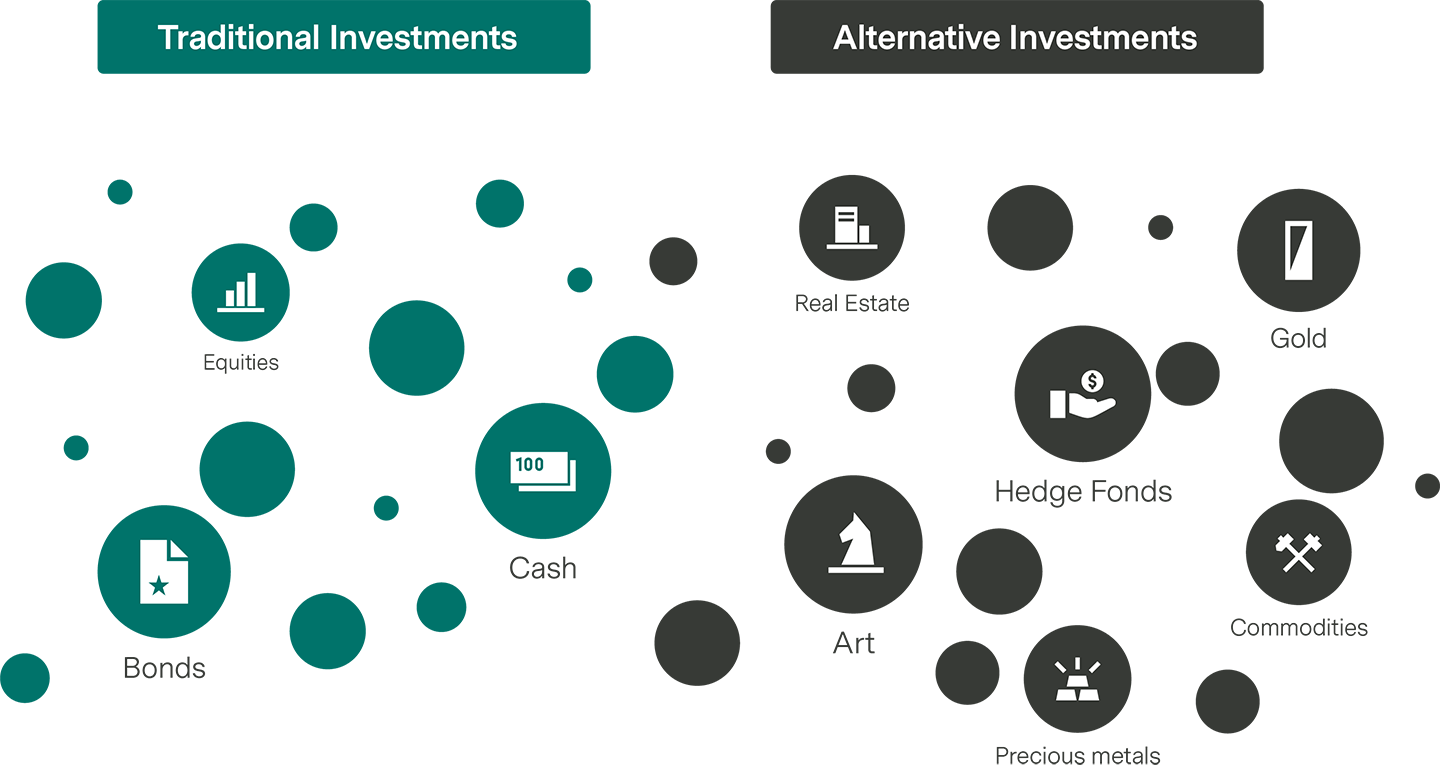

Alternatives to traditional investments

Alternative investments are all those, which cannot be categorized as traditional financial products such as equities, investment funds, bonds, or fixed-interest securities. Alternative investments are gold and commodities, for example, but also real estate and infrastructure projects, as well as hedge funds and private equity. Art objects, wines, and other tangible assets also belong to this category. The broad and diverse range of these “alternatives” therefore also has different investment forms and purposes.

Alternative investments in a portfolio

Alternative investments often correlate with the market to a lesser extent. Depending on the investment. They therefore tend to perform independently and in some cases even counter to the general events in the market. As a result, they are classically used in a portfolio as a way of spreading risk. One goal, for example, may be to hedge against inflation.

Investors should know the advantages and risks

Alternative financial investments are a way of improving the balance in a portfolio. At the same time, investors often expect an optimized yield profile from alternative investments and thus the possibility of greater yields. However, this may also come with a higher risk. The complexity and variety of alternative investments can sometimes place high demands on investors, so it is worth knowing the precise advantages and risks of the relevant asset class and carrying out analyses. For this reason, alternative investments have thus far been largely limited to professionally managed portfolios.

“Alternatives” have specific characteristics

In contrast to equities and bonds, many alternative investments are not traded on the stock exchange. Some of them may have only a limited circle of buyers, can only be traded from a high entry sum, or are tied to a fixed duration within which they can only be sold on a restricted basis, and sometimes not at all.

Alternative investment strategies may be embedded in public or in private markets. In addition, “alternatives” are divided into liquid and illiquid investments. For liquid investments, there is a market with a broad offering and sufficient demand. The investment can be bought or sold in large quantities at any time. For illiquid investments there is only a small market. This means that these investments, like private equity, private debt, or infrastructure, for example, can often not be traded at short notice, in the desired quantities, or without high costs.

Important investment options for investors

Investors often supplement their portfolios with the following alternative investments:

Gold. This common asset class is popular with many investors thanks to its promise of security. Gold can provide protection from inflation and often performs counter to the market—although not always. It is a proven strategy for hedging and diversifying a portfolio.

Commodities. Commodities are also classed by experts as investments that are less driven by markets. They can become an investment in various ways, for example through direct purchases, certificates, or futures. Commodities can be used for inflation protection and diversification.

Real estate. With this investment, investors get the chance to participate in rising real estate prices without having to own a house or an apartment. This usually works through real estate funds but is also possible directly through real estate projects. This alternative investment serves for yield optimization and can protect investors from inflation, for example.

Hedge funds. The name of these alternative investment funds points to their main purpose, i.e. to “hedge” against risks. However, they can also be used by those aiming to achieve above-average yields with a higher risk ratio. They involve a speculative investment strategy with active management by investment specialists. Active management offers the chance to achieve returns in different market conditions, so ideally investors can participate in upward movements in the market and at the same time protect themselves from downturns. In general, hedge funds are an investment option that can entail higher risks for investors.

Alternative investments permit diversification and yields

More and more investors are aiming to complement their portfolios with alternative investments, or even invest exclusively in this segment. This is due, on the one hand, to rising inflation and increased uncertainty in traditional investments, and on the other, due to the increasing ease of investing in “alternatives” via apps and investment platforms.

Alternative investments help to diversify a portfolio and can optimize its yield-risk ratio when applied correctly. They are therefore a way of taking into account risk considerations and act as a stabilizer, but they can also be geared toward optimizing returns.

The application of alternative investments is varied, complex, and often requires special knowledge. For this reason, anyone who is keen to supplement their portfolio with alternative investments should do their homework, get professional advice, or have their portfolio purposefully managed by experienced investment specialists.