“Market timing,” i.e. seizing precisely the right moment to benefit from a price rise or a downturn, is considered by many to be the highest art of investing. A glance at the past, however, quickly reveals that this is more of a myth than a discipline – nobody has ever really mastered it. Even investment professionals continually fail in timing the market. So how do you generate sustained yields with an appropriate risk ratio? Here too, looking to the past can be helpful: A long investment horizon and rigorous discipline have previously generated yields most reliably—regardless of when an investment was made. In other words: The best time to invest could always be now.

So when should I invest?

The ebb and flow of the stock markets lead many investors to want to maximize their yield through active trading. If you buy securities before the stock exchange starts to soar, you can make money.

At least that’s the theory. But as simple as this “market timing” sounds, it’s not so easy in practice. Even the renowned stock exchange expert John C. Bogle, founder of The Vanguard Group, had to admit that after 50 years in the markets neither he nor other experts he knew could have outperformed the market successfully in the long term.

When do equities rise and fall?

There are many factors influencing market prices: unexpectedly good or bad economic data, technological innovations, a pandemic, a stock trader’s blunder, wars, and sometimes even fraud scandals. To be able to assess price performance as effectively as possible, legions of market experts and stock exchange professionals work day in, day out, analyzing historical price movements, economic data, and company reports. This often enables them to come up with a good forecast for the general trend, but the precise timing of a crash or a sharp rise remains uncertain.

Even crisis winners whose success is down to market timing are most likely to have been dealt a lucky hand. The hedge fund manager Michael Burry, whose role in the financial crisis of 2008 was immortalized in the film The Big Short, was one of the few people who foresaw the collapse of the U.S. real estate market. He therefore started positioning himself against the housing bubble at an early stage—too early, in fact, as he was expecting the housing market to collapse from as early as 2005. His gamble nearly cost him his hedge fund.

Investment duration is more important than investment timing

If it is difficult for investment experts to determine the right timing, then for private investors it is virtually impossible. One valuable insight that ideally leads to another: Ultimately, only a long investment horizon, i.e. time in the market, is more profitable than attempting to pinpoint the perfect timing. Of course, the yield is higher if you enter the market at a low point, but speculating on this low point is unlikely to pay off.

Here’s one example from the comparison platform moneyland.ch: An investment of CHF 10,000 in the Swiss share index in early 2008 would have rendered a yield of 5.15 percent per year through to the end of 2020, so the invested amount would have risen to CHF 19,201.71. That’s a respectable yield when you consider the investment would have been made at a relatively high level at that point in time and that the financial crisis, the euro crisis, and the COVID pandemic have all shaken the financial markets during this period.

On discipline and irrationality

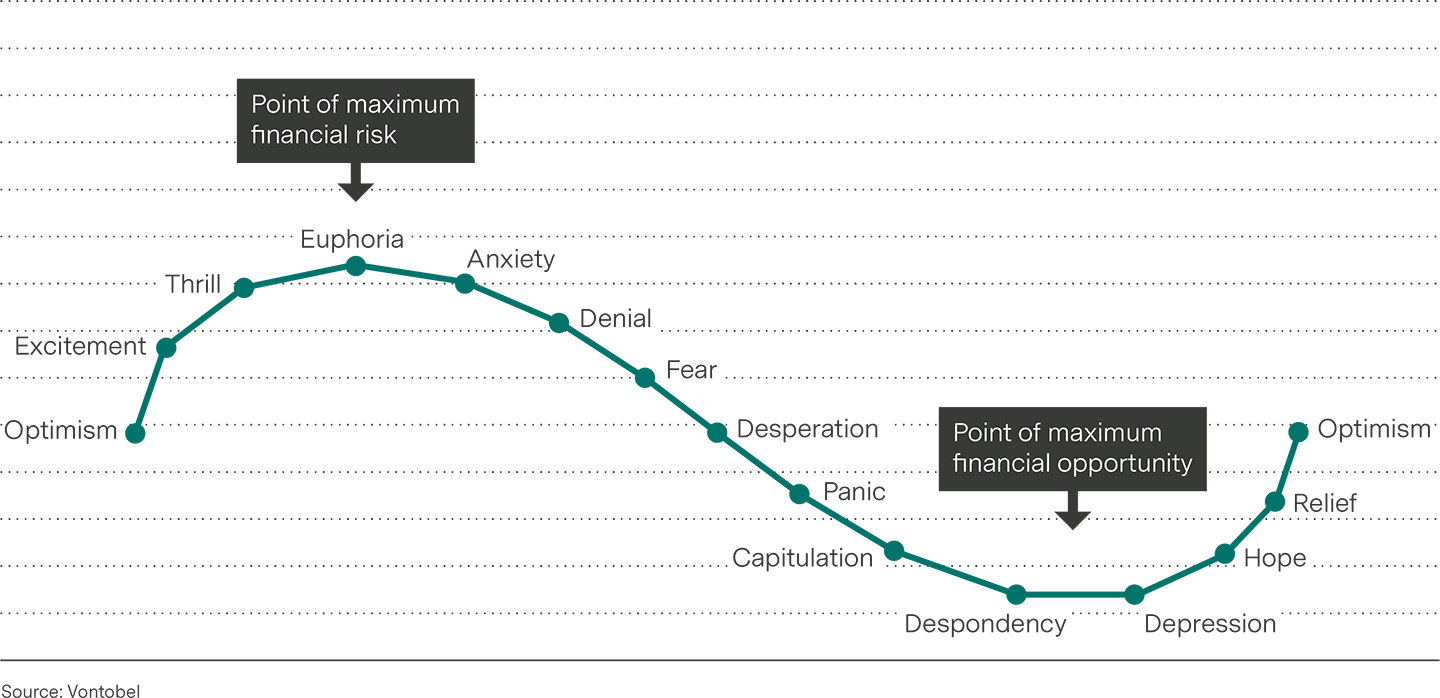

So why are so many investors nevertheless tempted to beat the market with perfect timing? The cause lies in human psychology. When prices are rising, there is euphoria, and when they fall, panic. It’s a rollercoaster ride of emotions. It is difficult to stand idly by and watch the value of an investment melt away, possibly irretrievably, during a period of weakness. The same goes for price rises. So-called “FOMO” sets in—fear of missing out—so many investors invest on impulse, only to later find that the price had already reached its peak.

The rollercoaster of investor emotions

There is an entire branch of research, known as behavioral economics, devoted to irrational investor behavior. Many of the behaviors studied in this research, such as overconfidence, herd behavior, and fear of regretting an investment decision later on, explain why it is virtually impossible from a psychological perspective to invest money at precisely the right moment.

But how do you keep your emotions in check when investing money? The long investment horizon has already been mentioned. On top of this, there is the discipline of not straying from the chosen path based on short-term price fluctuations and the emotions arising as a result. Those wanting to invest assets for the long term, should refrain from checking the daily goings-on of the stock exchange and focus on promising investment themes. Themes, for example, like ongoing digitization or sustainability, which offer potential in the long run.

Conclusion: Better to invest today than tomorrow

Not even investment experts always catch the right moment to enter or leave the market. A long-term investment horizon and the discipline to stick to the established strategy have led to the most reliable yields in the past.

It is irrelevant what point in time the investments were made. Over the long term, broadly diversified financial investments have almost always paid off. You could put it this way: The sooner you invest your money, the longer you can stay invested.