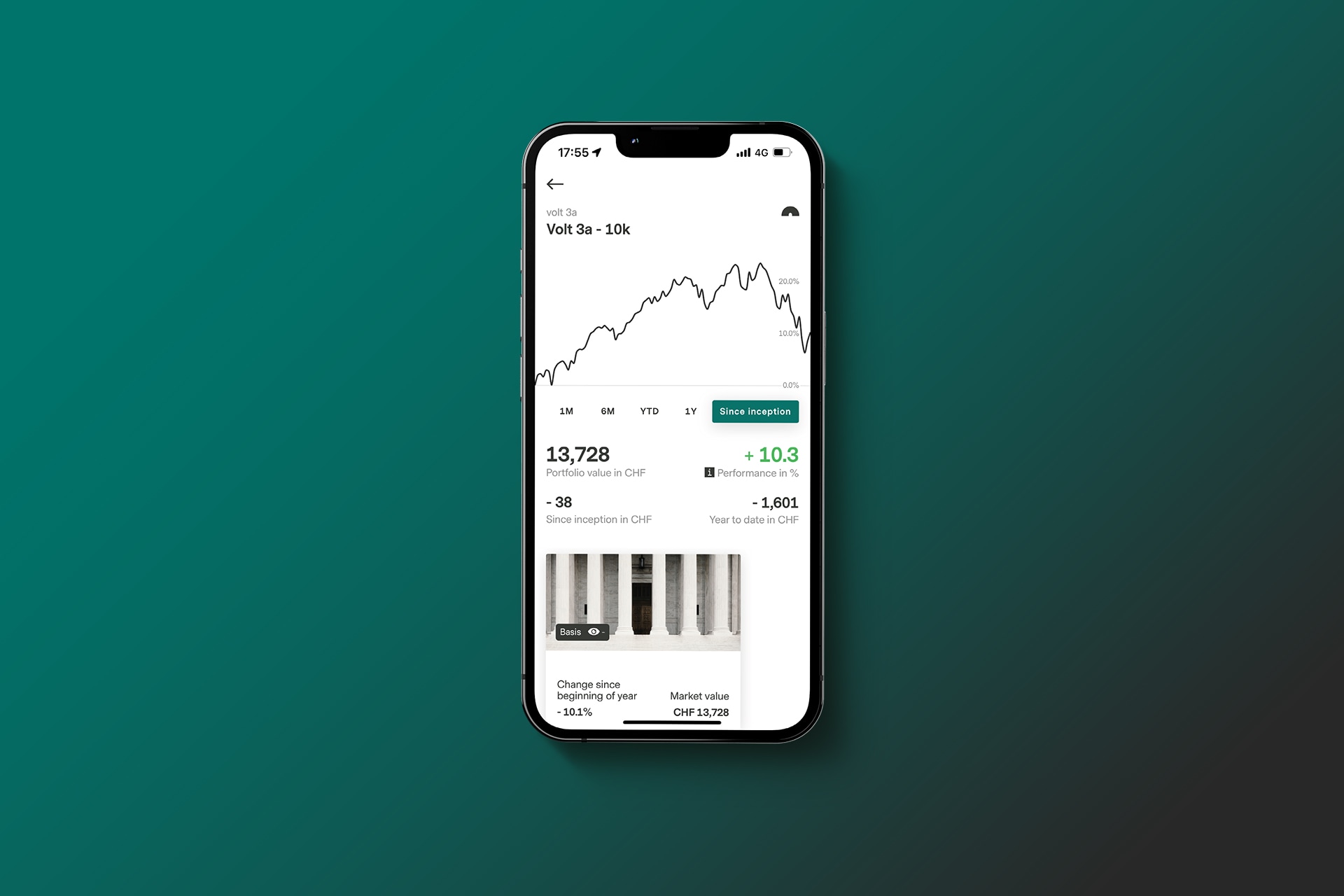

It's very simple: Those who are already Vontobel Volt customers can open their Volt 3a custody account in just a few clicks in the app. New customers first download the Vontobel Volt app on their smartphone and create a user account within a few minutes. If you only want to use Volt 3a and not Volt Invest, there are naturally no additional fees for your general Vontobel Volt account.

Good to know: Volt 3a is available to all gainfully employed persons with income subject to AHV contributions and who reside in Switzerland. The minimum investment amount is CHF 500. Subsequent deposits can be made without a minimum and in any amount.

Expert tip: To ensure that you receive the greatest possible tax benefit, Vontobel Volt allows you to manage up to five Volt 3a portfolios simultaneously. Find out more and benefit now in our pension hack.