A corner store in Delhi doesn't stand out. It's just one of many. But millions of mini-stores are a reminder that they are the backbone of the economy and vital for many people. E-commerce companies sense an opportunity to digitize traditional stores, expand their business model and profit in the process.

In the West, people usually go to a supermarket to stock up on everyday items. In addition to toothbrushes, socks and tea kettles, operators want to offer a shopping experience to ignite consumer desire. In Asia and Southeast Asia, many people go to stores just around the corner that are not fancy. Sometimes they are just simple kiosks or street stalls. Despite dusty shelves, they are the main link between the field and the dining table. In Indonesia, nearly 80 percent of food is purchased in traditional Warungs. The millions of small shops worldwide add up to a huge market worth at least US$900 billion. By comparison, the market of all supermarkets and grocery stores in the U.S. is about $750 billion.

Tech industry has recognized potential

The tech industry has discovered these atoms of everyday commerce lately. More than a billion dollars has been poured into dozens of startups by venture capitalists. These have set their sights on digitizing corner shops. No easy undertaking. After all, it involves changing habits that have existed for decades, even centuries in some cases. Many store owners order their goods by phone, do their accounting on paper, and shake their heads when someone wants to pay for the Red Bull can with their credit card. But the wave of digitization is slowly but surely catching even the small ones. Ismael Belkhayat, the CEO and co-founder of Chari, reports that more than 50 000 businesses have signed up for his accounting app. It reminds his clients' customers to pay their bills on time. Moroccan startup Chari's app also offers an e-commerce platform that allows stores to order inventory online instead of calling suppliers and paying cash when the goods arrive.

Pandemic accelerates development

The first startups partnered with corner stores several years ago. But a boom didn't emerge until the pandemic broke out. The restrictions forced people to buy food and other goods online. Technology companies were quick to respond. They offered apps that allowed mini-stores to take online orders and replenish their stock with cheaper products. In this difficult, economic climate, the microentrepreneurs were also open to the idea of making their store available as a temporary storage facility for packages to generate additional revenue.

Jeff Bezos also buys in

While there is global investment in startups whose business model is based on services for mini-stores, much of the money is flowing to Asia and Southeast Asia. Tens of millions are of small businesses there. Digital commerce platform ShopUp announced last year that it had raised $75 million. Never has a startup in Bangladesh raised such a large sum. But established large companies and wealthy individual investors are not standing aside. Jeff Bezos recently invested in Ula, an Indonesian start-up. It has already signed up more than 70 000 retailers for its merchandise ordering platform.

Large orders in China

Half the village places a large order? That's common in China. There, neighbors team up to place bulk orders for groceries via the messaging app WeChat and pocket the discount. The delivery is made to the owner of a small store, who receives, stores and distributes the ordered food. In addition, he is also the first point of contact if there are any difficulties with the order. In return, he receives a share of order value. Amazon has obviously been inspired by this and has teamed up with thousands of corner stores in India to build a network of small shipping centers.

Better than building an infrastructure: use the existing one

In areas with weak infrastructure, even huge e-commerce companies face the challenge of delivering their goods to homes reliably and quickly. That's where widely dispersed mini-stores lend themselves to pick-up deliveries. More than 20 000 small stores in India have signed up for Amazon's "I Have Space" program. They commit to making Amazon deliveries nearby or providing pickups - for a fee. This means Amazon already has a foot in the store door and can sell other digital services. Store owners can also take advantage of these because smartphones and 4G connections are widespread, even in the developing world. The unbridled appetite for market conquest by Amazon, as well as local giants like Reliance Group, are understandable when you consider the retail market of India.

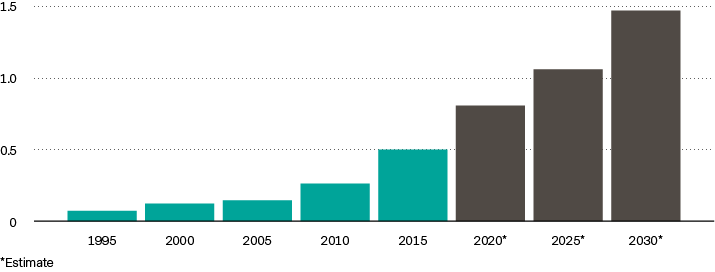

India’s rapidly growing retail market

(measurement in Billion USD)

Source: Technopak Advisors and Nasscom

Overcoming skepticism

It's not the case, however, that all mini-store owners are welcoming digitization with open arms. Walmart, one of the largest retail companies in India, has only worked with 1.6 million of the estimated 13 million small stores in the country. Some corner shops make sales under the table. E-commerce and the resulting digital trail would make it more costly to avoid taxes. But even for the largest share of righteous shopkeepers, cash remains the most convenient way to pay. The biggest hurdle for technology companies: They still have to convince people that what they offer is more cost-effective and better than doing business the traditional way.

Cooperate rather than be overrun

Fast delivery, unbeatable prices: Amazon has made life difficult for small stores, especially in the USA. The same need not be repeated in the global South. The millions of mini-stores could become a vital part of the digital economy. Instead of people shopping at the big retailers, they could continue to store at the stores they've known for generations. But they won't be dusty stores anymore; they'll be digital, more customer-friendly multi-talents that double as small warehouses and hubs for grocery delivery.

Last but not least, the digitization of corner stores in developing countries is also an excellent example of how economic sectors grow. E-commerce has been booming for years. Established companies, as well as start-ups in the online retail sector, do not seem to be running out of ideas on how to tap into new markets. This also creates opportunities for volt investors.

Risks of investing in financial markets

Investing in specific issues in international financial markets involves risk. The price, value and return of an investment, particularly in a special topic and across borders, depend on, among other things, economic developments, global attention to the topic in international financial markets and the price of the underlying securities.