Investors are increasingly starting to focus not just on yields but also sustainability. Many people want to invest in line with their values and do something positive at the same time. But can you combine a clear conscience with promising yields from your investment? The topic of sustainable investing continues to spark questions, preconceptions, and myths.

What does sustainable investing mean?

The increasing impacts of climate change and growing environmental awareness within society have for some years given rise to a trend for sustainable investing—among both companies and investors. But how can you define sustainability in investing? One option is to evaluate companies based on social, ecological, and ethical factors. As the basis for such an evaluation, the finance industry is increasingly turning to so-called ESG criteria.

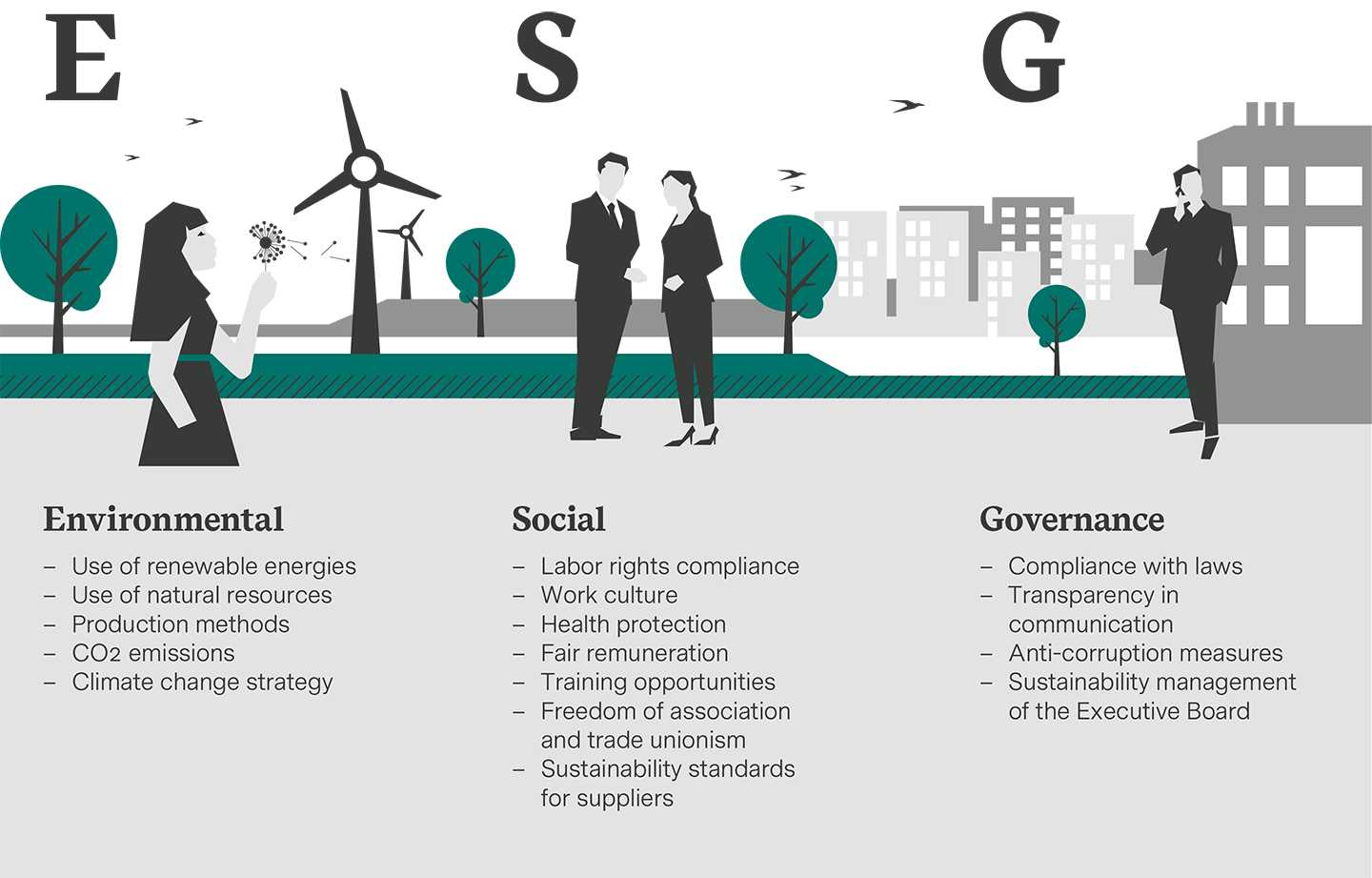

ESG criteria are centered around three fundamental questions: How does a business behave in relation to the environment? How does it behave in relation to society? And how does it shoulder its responsibility in its business management?

What does ESG stand for?

ESG stands for Environmental, Social, and Governance and is a classification system for evaluating the sustainability of businesses. Previously, it was hard for investors to get an idea of whether and to what extent investment options were sustainable, but ESG criteria now provide guidance so that investors can better assess the sustainability of a financial investment.

ESG criteria are also becoming increasingly important for companies, in order to remain attractive to investors. Studies from 2021 show that 70 percent of the companies assessed have an ESG strategy paper that formulates both a vision and a specific path toward the achievement of sustainability goals. This compares to 65 percent in October 2020. 62 percent of companies also underpin their ESG initiatives with key performance indicators, up from 51 percent the previous year, with the intention being to make efforts in this area quantifiable. However, general engagement with sustainability issues may by now be a reality at almost all companies.

What does ESG include?

With Environmental, represented by the “E” in ESG, companies are assessed based on their use of renewable energies, their use of commodities, their production methods, and their strategy in relation to climate change. There is particular emphasis on CO2 emissions.

Social, the “S” in ESG, covers how much a company takes social and societal aspects into account. This includes compliance with labor laws, work culture, occupational health, fair wages, opportunities for further training, and freedom of assembly and trade unions. It also looks at whether a company enforces sustainability standards among its suppliers.

Governance, the “G” in ESG, covers compliance with legislation, transparent communication, measures against corruption, and sustainability management within the executive board. The evaluation also looks at whether remuneration for board members is linked to sustainability goals.

Ranking agencies, banks, and various companies in the finance industry evaluate whether a company meets ESG criteria and can therefore be labelled sustainable, and this helps investors to make decisions, manage risk, and utilize yield opportunities. (Absatz nach goals?)

How are the yields?

For a long time, there was a persistent view that sustainable investing could not render reasonable yields, but analyses suggest that this view is not correct per se. If sustainability criteria are realized correctly, then this can actually benefit yields.

Studies show that sustainably oriented companies are often even able to reduce risks through forward-thinking actions, so high standards and a conscientious approach to sustainability can have a positive impact on the share price in the long term and thus on achievable profits.

How can I protect myself from greenwashing?

Green is the “in” thing right now, and it is certainly possible that some companies may create a veneer of sustainability to profit from this important trend. This is known as greenwashing.

So how can you distinguish between a company or fund with sustainable aims and a free-rider? ESG criteria, which are intended to make sustainable investments more easily recognizable, have been helpful so far in this respect. Meanwhile, at the start of 2022, the EU taxonomy came into effect, providing a set of rules for the European Union that initially defines criteria for climate-compatible investing. Both these tools help provide guidance in the sustainability jungle.

Sustainable investing enables yields based on conviction

Sustainable investment solutions help investors to invest their money successfully and in line with their values. ESG criteria can provide guidance here. With volt by Vontobel, the basic investment is composed exclusively of investments that have been selected with the help of ESG criteria, regardless of the chosen risk profile.

On closer inspection, the common preconceptions and myths about sustainable investments are not always correct: With the right ESG investments, you can invest conscientiously to support positive change—and see returns at the same time. Experts even say that ESG criteria can help keep investment risks under better control by promoting transparency and long-term corporate planning— a good reason for investors to consider sustainable investing.