Alternative Investments: Why Is It a Good Idea to Invest in Commodities Now?

Volt News- Commodities are natural resources or resources created in nature that are used in numerous products in our everyday lives. These include crude oil, natural gas, but also metals and agricultural produce.

- Experts choose to invest in commodities because they represent a protective asset in their portfolios.

- Two developments suggest that commodities will continue to be suitable for portfolio diversification and return enhancement in the future.

When the market resembles a roller coaster ride, many investors start to turn to alternative investments ("Alternatives"). Because of their special characteristics, they are often used for diversification in portfolios. However, every alternative investment is different and can develop individually depending on the market situation, which is why some investors are reluctant to embrace them. Yet, with the right investment strategy, "Alternatives" offer valuable protection as well as the opportunity for additional returns. Alternative investments also include commodities, which made strong gains at the beginning of the year. This raises the question of whether the time has come to invest in commodities. Because as it looks, commodities are likely to remain in demand.

What Are Commodities?

Commodities are created in nature or extracted from it. Thus, they are used as a foundation for various goods. Although this definition includes a variety of raw materials, they can be divided into three groups:

Agriculture: The so-called "agricultural commodities" comprise resources that are generally used to produce food and animal feed. These primarily include cereals, fruits, and vegetables, but also animal products such as meat, milk, and eggs. Other important commodities in this category are oil plants, cotton, cocoa, coffee, and sugar.

Energy: Resources such as crude oil, natural gas, coal, and hydrogen belong to the most important energy sources. The former is not only used as a base for automotive fuel, aviation kerosene or heating systems. Rather, crude oil is found in numerous plastics that shape modern industrial society: be it in smartphones, coffee cups, shoes, or clothing.

Metals: On one hand, this includes industrial metals such as aluminum, lead and iron - with iron being a key raw material for steel production. On the other hand, the category also includes precious metals such as gold, platinum, and silver. Precious metals are often used as an investment in times of crisis, as they have potential to develop in the opposite direction to the market.

Why Is It Worth Investing in Commodities?

Commodities are not called the "dark horse" in bear markets without reason: They are often used as diversifiers in portfolios because they have historically performed well even in times of inflation and geopolitical crises. Because commodities are indispensable for a large part of the goods we need every day, their price fluctuation is often kept within limits. However, the current situation suggests that commodities may develop differently than expected in the near future.

Commodities may soon have more than a stabilizing effect on diversified portfolios: a new "supercycle" may be looming for them. In a normal market dynamic, increasing demand is balanced by higher production. Supply is thus increased in line with demand, thereby serving it and driving down prices. In a supercycle, however, demand cannot be met, and commodity prices rise for years or even decades. Two major drivers make this scenario increasingly likely.

Reason 1: Raw Materials for Electrification Will Be Increasingly in Demand

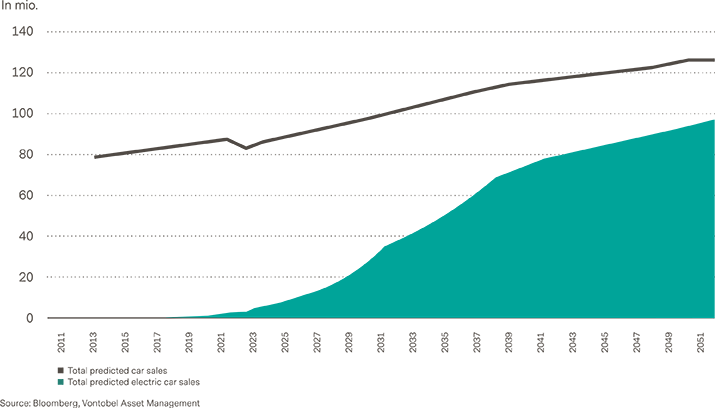

The EU has issued the "Fit for 55" climate package, which contains various legislative proposals for longer-term CO2 reduction. One of these applies to mobility: As a result, the production of passenger cars with gasoline or diesel engines is prohibited from thx ear 2035 onward. One of the reasons behind this decision is the high environmental impact of road traffic. Around 20 percent of greenhouse gas emissions in the EU are caused in this sector. Accordingly, the EU Parliament's measure is intended to reduce total greenhouse gas emissions by 55 percent by 2030 compared to 1990. By 2050, after all, the EU aims to become carbon-neutral, according to its own definition. This resolution is also expected to boost sales of electric vehicles in the coming years, as the chart below shows.

Electric Vehicles Sold Worldwide Compared to All Passenger Cars Sold

Some of the players involved already seem to be preparing for the electrification. VW sees the EU's plan as "ambitious, but feasible". Mercedes goes one step further: The Stuttgart-based company is already prepared to switch completely to e-vehicles from 2030 under certain circumstances.

However, the ban will not only affect the automotive sector but will also result far-reaching changes for large parts of the industry. Widespread electrification will require entire infrastructure and energy companies as well as new suppliers. In addition, various regulations still need to be elaborated and eventually come into effect to achieve the "Fit for 55" targets.

In a second step, the EU program is likely to have an impact on countries outside the alliance. South Korea, Israel, Japan, and Canada have already joined in and are planning to introduce a production stop for gasoline-powered small cars from 2025 at the earliest. The scope of this EU decision is a substantial one and is therefore likely to sustainably increase demand for the raw materials needed for electrification.

Reason 2: Fossil Fuels Will Also Remain Scarce

Commodities have been in short supply for some time now, and consumers are feeling the effects in different areas. Recently, it has been increasingly noticed that certain goods such as electronics and wood products have become more expensive, products are not available, or customers must put up with long delivery times. Although this has already become the norm since the outbreak of the Covid 19 pandemic in 2020, today the war in Ukraine and China's Zero Covid policy are exacerbating this effect. Ultimately, this means that scarce resources will become even scarcer and that the rate of inflation, hence the price consumers pay for goods and services, is likely to remain elevated despite the efforts of governments and central banks.

States such as China, Russia and Ukraine are important suppliers of numerous raw materials: Accordingly, vast quantities of fossil fuels such as crude oil, natural gas, coal, but also metals such as steel, aluminum, and nickel as well as agricultural raw materials are in the hands of these countries. It remains unclear when China will fully open the gates for goods traffic and when the situation in Ukraine will stabilize again.

This means that the supply of various commodities from Russia and China is limited or not possible at all. At the same time, there is no answer as to how the resulting shortage of commodities can be covered in the near future. After all, purchasing fossil fuels from other countries cannot fully compensate for the current shortfall. Establishing alternative energy sources would take a long time, so this option is also out of the question as a short-term solution. Thus, an increasing demand for commodities for alternative energy production and electrification of road transport meets a shortage of fossil energy sources such as oil and gas.

In other words, there seem to be many indications that the scarcity of most energy-related commodities will persist and that their prices are likely to rise further for the time being.

Conclusion: The Future of Commodities

There seem to be many reasons to invest in commodities, and not only in the current “bear market”. In the future, the EU's decision is likely to lead to an increase in the value of those commodities that are necessary for the widespread switch to electromobility. This primarily concerns precious metals and rare earths, which serve as conductors or are needed for battery technologies. However, the phase-out of gasoline engines does not mean that the price of oil and gas will drop. On the contrary, demand for fossil fuels is likely to remain high due to existing energy shortages caused by China's Zero Covid policy as well as the war in Ukraine. After all, it will still take a long time until a transition to sustainable energy takes place. Thus, commodities are likely to remain suitable for portfolio diversification and return enhancement in the coming years, irrespective of the markets.

Sounds interesting? With volt by Vontobel, you can participate in the development of various investment themes as well as alternative investments such as commodities and cryptocurrencies.

Risks of investing in financial markets

Investments in special topics on the international financial markets are associated with risks. The price, value and return of an investment, particularly in a special theme and across borders, depend, among other things, on economic developments, the global attention given to the theme in the international financial markets and the price of the underlying securities.