- In today's world, anyone who wants to make the most of their assets cannot rely solely on their savings account.

- Furthermore, the current circumstances reward a healthy balance between saving and investing.

- Thanks to the progressing digitalization, there are many options for investing your money sustainably. CTA

Even in the past, savings accounts have hardly been lucrative. But saving is easy, doesn’t require any specialist knowledge, and over time savers are able to put aside quite a bit of money. Yet times have changed, and now low interest rates in combination with inflation mean that amounts saved can decrease in value. One alternative to saving is investing money. And thanks to ever better apps and online offerings, the days where investing was complicated, are over.

Low Interest Rates Make Saving Unattractive

Previously, you could pay a little money into a savings account every month, and interest rates would help turn it into a tidy sum over the years. But since the onset of the financial crisis in 2008, interest rates have fallen sharply and in some countries are even below zero. If banks only get a little interest on the capital they lend or even pay negative interest rates, they can only offer low yields to holders of savings accounts in return. On top of this, there is inflation.

Gradual Loss of Value Due to Inflation

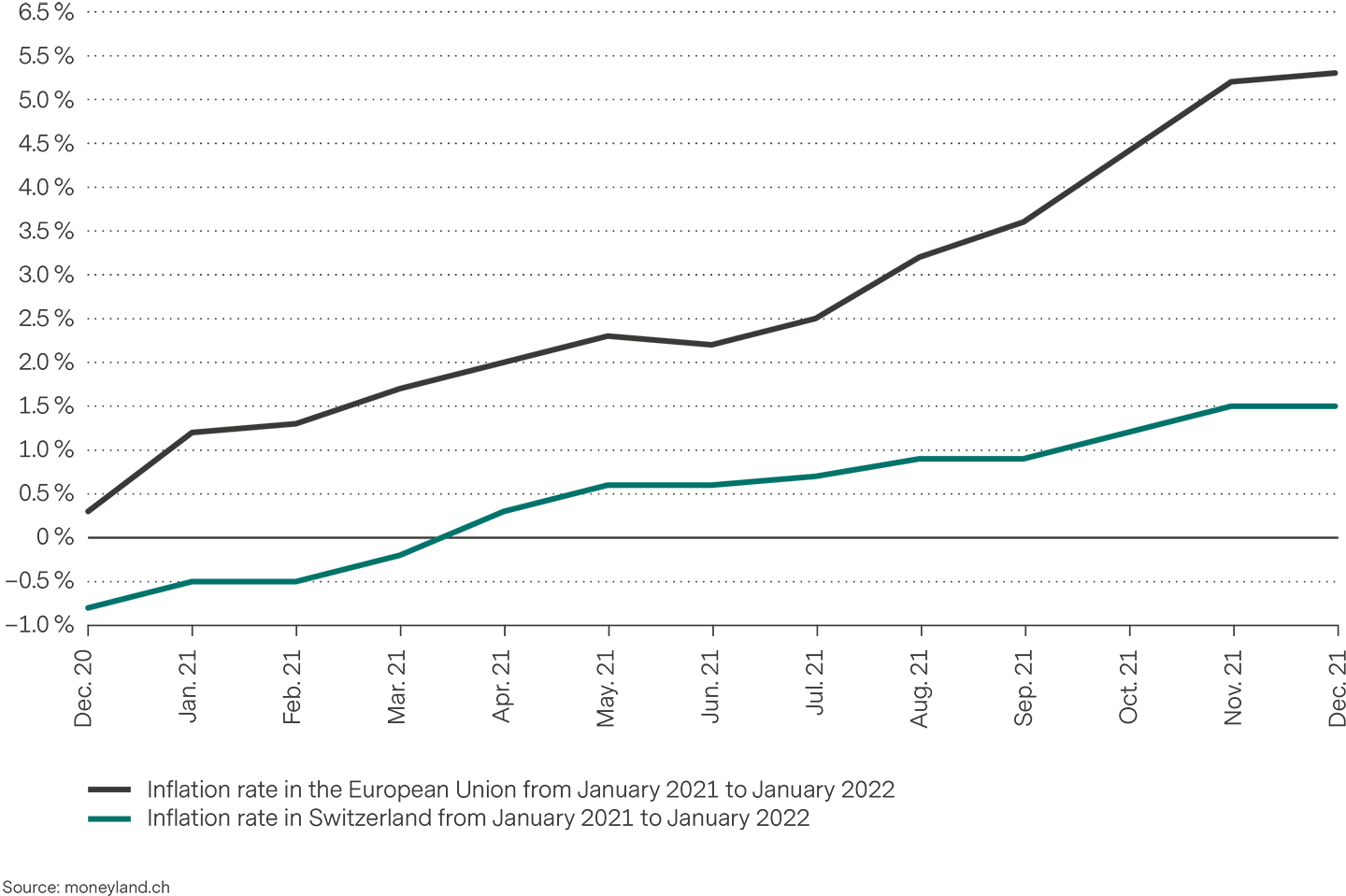

Until recently, inflation rates in industrialized countries were relatively low, and even if money in an account wasn’t accruing interest, then at least it wasn’t losing value. But this, too, has changed. Both in Switzerland and in the Eurozone, inflation rates rose strongly during 2021. Hence, in November 2021 Germany’s Federal Statistical Office calculated its inflation rate at 5.2 percent, while the Federal Statistical Office in Switzerland evaluated its rate at 1.5 percent.

Comparison Inflation Rate EU and Switzerland

It is possible that this increased inflation will go on for a while. In its monetary policy assessment of September 2021, the Swiss National Bank (SNB) assumed an inflation rate of 0.7 percent in 2022 and 0.6 percent in 2023—although this is low in comparison to the EU and the U.S. That means that money in a savings account not only accrues no yield but actually also decreases in value—another reason to consider investing. And then there is the pension gap.

Pension Gap Becomes Apparent

In the past, people could rely on a state pension, but the pension system is increasingly reaching its limits: In industrialized countries in particular, populations are getting older and older, which means that more and more people will be drawing their pensions at the same time.

According to the Federal Statistical Office, in Switzerland by the year 2050 for every 100 people of working age there will be 46.5 pensioners (only in German), while Germany’s Federal Statistical Office estimates the proportion to be 65 pensioners. The proportionally ever smaller number of working people therefore has to finance the pensions of ever more retirees, so it’s likely that pension amounts will no longer be able to rise. That means anyone who wants to retire in comfort should consider acting themselves.

Investing and Saving: A Comparison

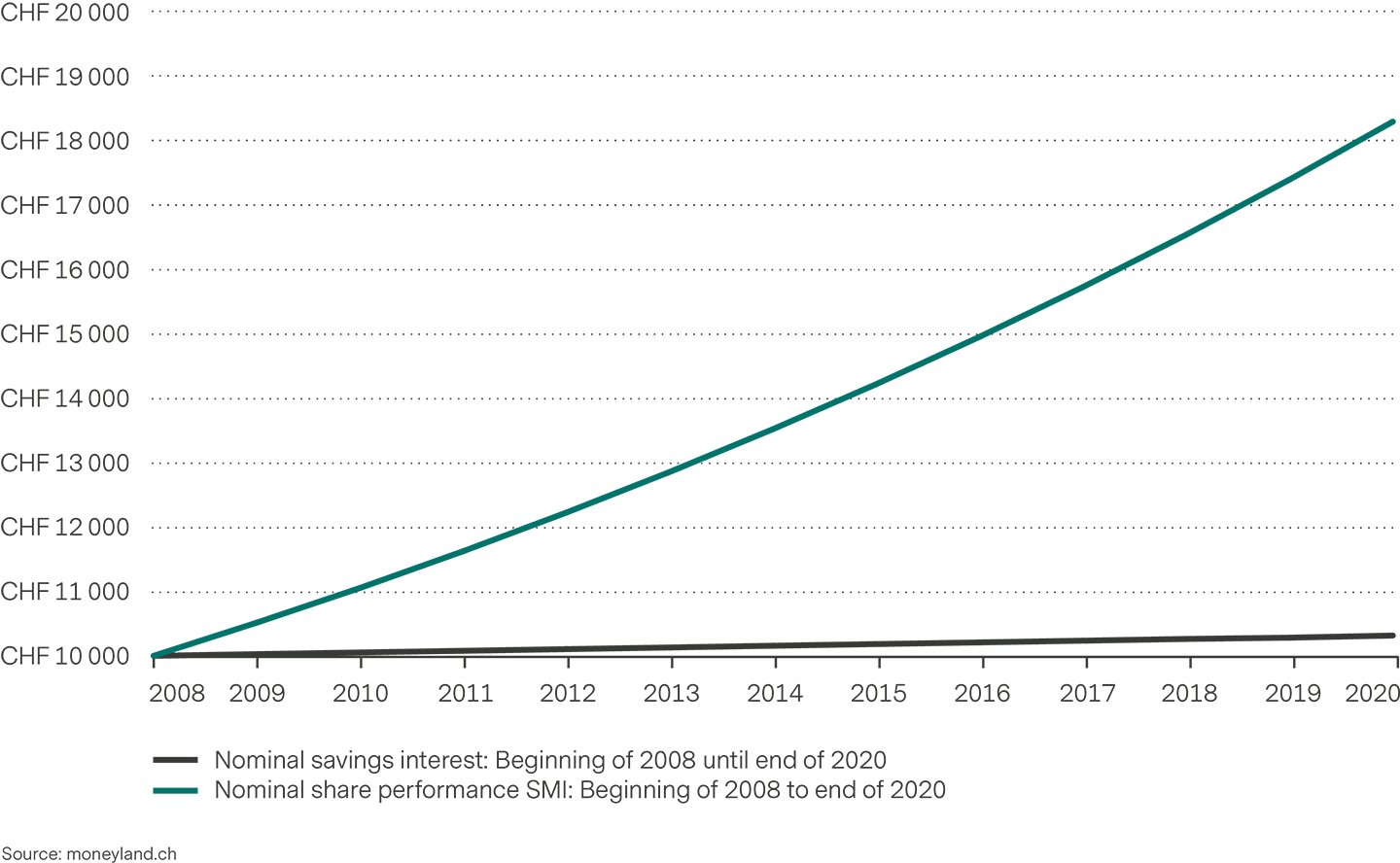

What exactly are the benefits of investing compared to saving? According to a sample calculation by the online comparison service moneyland.ch, an investment of CHF 10,000 in a savings account in the year 2008 would have yielded average real interest of 0.26 percent per year through to the end of 2020. That means that after 12 years the amount in the bank account would have risen to CHF 10,338.67.

If those CHF 10,000 had been invested in equities, for example in the Swiss Market Index (SMI), then the average yield—depending on precisely when the money was invested in 2008—would have been slightly over 5 percent every year. That means that by the end of 2020 the invested amount would have risen to around CHF 19,000. That’s almost twice as much as with the savings account. It’s true that growth can never be guaranteed on an investment, and that investments can also develop negatively, but the example does show the potential of investing.

Comparison Average Performance Swiss Savings Interest and SMI Shares With Reinvested Returns Since 2008

The sample calculation demonstrates that, in the past, investing has generally resulted in better yields than saving, and yet investments are still seen as too risky. It is possible, however, to achieve a reasonable ratio between expectations and the risk to be entered into if you consider a few important principles: long-term goals, a diversified portfolio, and an investment strategy adapted to your own risk tolerance. It also matters how much of your free assets you invest, and that always depends on individual circumstances. There should always be a certain proportion of money not invested as a buffer so that you don’t have to sell your investments at an inopportune time. Sounds complicated?

Should You Invest All Your Money?

Even for those who don’t want to abandon savings accounts entirely, it makes sense to consider additional forms of investment. It’s true that past performance can never be taken as a reliable indicator of future results, but the sample calculation at least shows that anyone wanting to preserve or increase their assets in tense times like these cannot afford to ignore alternatives to saving.

Thanks to app-based investment opportunities, professional investment strategies are now accessible even with smaller amounts. Offers range from simple digital funds to pillar 3a options, through to themed investments with portfolios that are actively managed by investment experts. In principle, however, anyone can start investing even with small amounts.

Sounds interesting? With volt by Vontobel, you can participate in the development of various investment themes as well as alternative investments such as gold and cryptocurrencies.

Risks of investing in financial markets

Investments in special topics on the international financial markets are associated with risks. The price, value and return of an investment, particularly in a special theme and across borders, depend, among other things, on economic developments, the global attention given to the theme in the international financial markets and the price of the underlying securities.